Streamlining financial workflows: How automation solves your biggest challenges

Table of contents

Try Workflow Automation free for 14 days

Finance is one of the most process-driven industries in the business world, and finance teams deal with a lot of documents — from invoices and purchase orders, to expense reports and financial statements. They also have to keep their documents accurate for audits, make sure they follow all laws and regulations, and prevent fraud at the same time.

It’s a tall order, and a high level of efficiency is an absolute must.

But when finance teams rely on manual processes to manage this workload, not only is it inefficient, but it’s also risky. Manual processes can lead to bottlenecks, compliance errors, and an increased risk of errors and fraud — all of which can put an organization at risk.

There’s a better way to handle financial processes, one that solves all the problems that come with managing processes by hand: finance workflow automation.

Workflow automation can revolutionize financial processes within a business. But what kind of improvements does automation offer, and how can you implement workflow automation to experience those improvements?

How manual processes hold back finance teams

Before diving into how finance workflow automation can increase efficiency and address the problems that come from manual processes, this section will cover some of the challenges finance teams encounter.

“People still rely on spreadsheets, email chains, and printed documents in many finance departments,” says James Francis(opens in a new tab), CEO of Paradigm Asset Management(opens in a new tab) and founder of Artificial Integrity(opens in a new tab), an AI consulting firm dedicated to mitigating AI bias, ensuring fairness, and promoting transparency. “This creates bottlenecks, opens doors to compliance risks, and gives auditors a migraine when it’s time to review. Delayed reconciliations, missed approvals, and misplaced records are expensive and annoying.”

More specifically, manual processes can hold back finance teams in a variety of ways.

Increased risk of errors

It doesn’t matter how detail-oriented your finance team is — they people on the team are humans, and humans make mistakes. And when your team is handling financial data and processes by hand, there’s a higher chance of making mistakes. These mistakes can have serious consequences, like losing money. Some common mistakes include:

- Data entry mistakes — When your team is entering financial information manually, there’s always a chance of data entry errors. A typo, an added or missing number, or even one data entry mistake can wreak havoc, causing issues like incorrect financial records, overpayments, or inaccurate financial forecasting.

- Calculation errors — Manual calculations, such as the CapEx formula, can lead to mathematical errors, which can then lead to incorrect financial reports, budgets, and forecasts.

- Missing information — With manual processes, it can be easy for team members to accidentally skip steps or forget to include important information. For example, they might not get the approval they need or leave out important documents from a report. This can lead to compliance problems.

Inefficient approval workflows

One of the biggest challenges with manual processes? The approval bottlenecks they create.

Manually managing the approval process can cause serious delays and challenges in your financial operations, including:

- Physical routing delays — If your team still uses paper documents, it’ll need to physically deliver those documents from one approver to the next. This can cause big delays, especially if the approvers are in different places.

- Approval tracking challenges — Keeping track of the “approval paper trail” — or where documents are in the approval process — can be extremely difficult with manual systems. For example, is the invoice sitting on someone’s desk? Has it been approved, but not yet processed? Has it even been printed yet? Without an automated tracking system, it can be hard to know.

- Approval inconsistencies — Different people have different ways of doing things. When different team members approach the approval process differently, it can lead to inconsistencies, which cause problems in any organization.

Compliance risks

Finance teams are bound to all sorts of regulations and compliance requirements. Manual processes can make compliance more challenging, increasing the risk of non-compliance and all the consequences that can come with it.

- Inadequate documentation — Compliance often requires up-to-date and thorough documentation of all financial processes and decisions. With manual systems, it can be easy for required documentation to fall through the cracks.

- Inconsistent compliance practices — As mentioned, inconsistent processes cause problems — and that includes compliance issues. When team members follow specific rules, there’s always a chance of mistakes. This is especially true if those rules aren’t clearly written or if team members have different ideas about how to do them.

- Unclear/incomplete audit trails — Clear audit trails are a must-have for compliance. But because manual processes make it more likely that mistakes and omissions will happen, they can also lead to unclear or incomplete audit trails.

Increased fraud risk

Fraud protection is another priority within finance. But manual financial processes can create serious opportunities for fraud — both internal and external.

Manual processes can increase fraud risk in a variety of ways, including:

- Unauthorized transactions — Manual processes may not have the controls needed to stop illegal transactions from happening. For example, an employee may approve a bank transfer to a personal account to steal money from their company.

- Altered documentation — If you know what you’re doing, paper documents can be altered or falsified fairly easily, increasing the risk of fraud.

- Limited oversight — There are so many financial processes needed to keep a business moving forward. Trying to manually keep track of all of those processes is extremely difficult (if not impossible). This lack of oversight could allow fraudulent activity to go undetected over a long stretch of time.

Processes that take longer than they need to

The more efficiently you can get work done without sacrificing accuracy, the better. But here’s the thing: Manual processes are simply slower and more labor-intensive than automated ones, which can lead to:

- Delayed payments — Manual invoice processing can delay payments to vendors, which could lead to a host of issues like fees, damaged vendor relationships, or missed opportunities like early payment discounts.

- Time-consuming reporting — Creating financial reports manually takes (a lot of) time that could be better spent on other things, such as strategic work or employee development.

- Resource drain — The amount of time needed for manual financial processes is a drain on resources — particularly labor — that could be better used elsewhere. Why use your most valuable resource to tackle mundane tasks that could be automated?

How finance workflow automation can revolutionize your business

Clearly, manual financial processes present some serious challenges. But finance workflow automation offers a solution to those challenges that can completely transform how your finance team operates and approaches work.

“Automation is like setting up a self-driving approval highway — and it’s changing the game,” says Francis.

This next section will look at some of the ways automation can improve financial processes.

Streamlined capital expenditure approvals

Capital expenditure (CapEx) approvals are a critical part of financial planning. But they can also be one of the most complex and time-consuming processes for finance teams, especially if they’re trying to manage them manually. CapEx approval software can streamline this process by:

- Automating the approval workflow — CapEx approval software can automatically route capital expenditure requests to the right approvers based on predefined rules. For example, “we built approval workflows based on spending thresholds,” says Andrew Lokenauth(opens in a new tab), Fractional CFO and founder of BeFluentInFinance.com(opens in a new tab). “Anything under $10K gets auto-routed to department heads, while bigger purchases follow more complex paths.”

- Providing real-time visibility — Unlike paper, automating CapEx approvals allows finance teams to see exactly where a request is in the approval process at any given time. This prevents approvals from slipping through the cracks and keeps the process moving forward — no endless followup emails or calls are necessary.

- Enforcing approval policies — Automated systems create consistency. When you use CapEx approval software to automate the process, it’s easy to ensure all approval policies are consistently followed. For example, require additional approvals for expenditures over a certain amount.

- Facilitating better financial planning — By streamlining the CapEx approval process via automation, finance teams can more accurately forecast capital expenditures and incorporate them into financial planning.

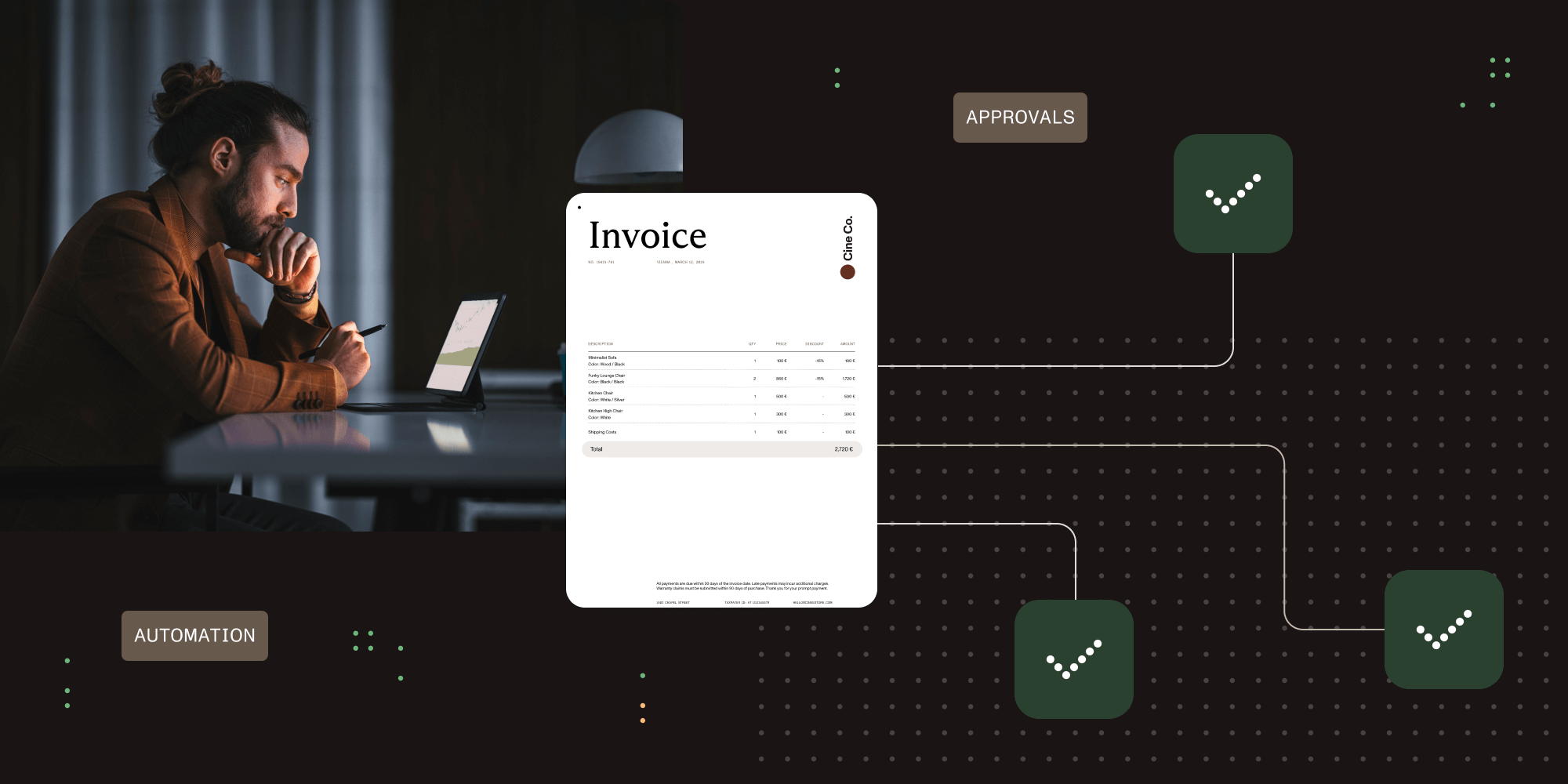

Eliminated approval bottlenecks

As mentioned, the approval process can create serious bottlenecks. And one of the biggest benefits of finance workflow automation? Eliminating those bottlenecks.

Automated approval workflows can:

- Route documents automatically — Instead of manually passing documents from one approver to the next (which not only takes more time, but also creates more opportunities for errors, delays, or lost paperwork), automated systems route them electronically, reducing transit time and ensuring they reach the right people at the right time.

- Send automatic reminders — When approvals are managed manually, it’s easy for documents to get caught up at different stages of the process. But with automated systems, you can set up alerts to notify approvers automatically if an approval is pending for too long, keeping the process moving forward. “There’s no more chasing signatures…because requests zip through based on logic you define,” says Francis.

- Provide alternate approval paths — If a primary approver is unavailable, automated systems can route documents to alternate approvers, preventing delays due to individual unavailability. For example, let’s say the CFO is the primary approver, but they’re going on vacation. With an automated system, they could designate the controller as the alternate approver, keeping approvals moving forward even while they’re out of office.

- Enable mobile approvals — Many automated approval systems allow approvers to review and approve documents from their mobile devices, meaning approvals can happen from anywhere, at any time.

Improved accounts payable (AP) processes

Financial services accounts payable automation transforms the way your organization handles invoices and payments through:

- Automated invoice processing — Automatically extract data from invoices, match them to purchase orders and receiving documents, organize them by vendor, and route them for approval — dramatically reducing manual data entry and processing time.

- Streamlined payment processing — Not only can you automate the approval process, but you can also automate payments, which ensures payments are made on time.

- Improved vendor relationships — By processing invoices and payments more efficiently and in a timely manner, your organization can build better relationships with vendors — which could lead to better terms and conditions.

- Reduced costs — Automating AP processes makes them more efficient and less time- and labor-consuming, which can ultimately help reduce costs.

Enhanced audit readiness

Audit readiness is a huge priority in finance, and automation can significantly improve your organization’s readiness. “Audits can be intimidating, but automation makes them less so,” says Francis.

Some of the ways automation can increase audit readiness include:

- Creating comprehensive audit trails — Digital audit trail solutions automatically log every single action related to financial processes, including what happened, when it happened, and who did it. A clear, detailed audit trail ensures audit readiness.

- Ensuring document retention — Financial document workflow software not only makes your documentation process easier, but it ensures all financial documents, like invoices and P&L reports, are kept according to your company’s rules and regulations. This helps you keep your documents in good condition.

- Standardizing processes — Automated systems standardize financial processes, eliminating human error or misinterpretation, and creating consistency across the organization.

- Providing quick access to documentation — During an audit, you need to be able to easily and quickly access all relevant information. Digital audit trail solutions allow you to quickly locate and provide any requested documentation, which can make the process a lot less time-consuming and stressful.

Increased protection against fraud

One of the most important benefits finance workflow automation provides is increased protection against fraud. “Fraudsters love loopholes,” says Francis. “Automation can help close them. By segregating duties, enforcing approval chains, and flagging suspicious behavior, you can easily avoid mistakes and filter out fraud bots.”

Automated systems can help your firm avoid fraud in multiple ways:

- Segmenting duties — When one employee is in charge of a process from beginning to end, the potential for fraud increases. Automated workflows can divide tasks, so that no one team member can control more than one part of a financial transaction. This also helps reduce the risk of internal fraud. “We’ve set up automated segregation of duties, so no single person can create and approve transactions,” says Loukenath. “It’s like having a digital watchdog working 24/7.”

- Implementing approval thresholds — While all fraud is detrimental, higher amounts can definitely do more damage. With automated solutions, you can ask for more approvals for transactions over certain amounts. This makes larger transactions more careful and protects against fraud from high-ticket transactions.

- Flagging suspicious activities — As mentioned, because of the sheer volume of information, it can be hard to spot suspicious activity when you’re managing processes manually. With automated systems, you don’t have to be the one to spot it; these systems can identify suspicious transactions and flag them for review, helping catch fraudulent activity before it becomes a major issue.

- Creating a clear record of all activities — Automated systems log each and every activity related to financial processes. As such, if your organization is ever a victim of fraud, these systems make it much easier to figure out where the fraud is coming from.

Finance workflow automation best practices

Want to start automating financial processes in your business? Here are a few best practices to keep in mind:

- Document your processes before automating — Before you jump into automating processes, it’s important to understand how your processes are currently being managed and where any inconsistencies exist. “Document your existing workflows first,” says Loukenath. “You’d be surprised how many ‘standard’ processes actually vary between teams.” Once you’ve gathered the information, determine the most efficient way to navigate the process, document it, and then automate accordingly.

- Start small — You might be tempted to go all-in with automation. But if you’re new to automating processes, it’s best to start small. “Start small and then scale later on,” says Francis. “The goal is to evolve and scale over time, so don’t aim for a total overhaul on day one.” Taking a long-term approach to automation will help make implementation more successful, rather than overwhelming your team with a slew of new processes from the get-go.

- Choose the right tools and technology — How successfully you’re able to automate finance processes in your organization will, in large part, depend on the tools and technology you use. Identify what it is you need from automation software, do your research, and choose the tools that are going to deliver what you’re looking for — not only from a functional standpoint, but from a security and compliance standpoint as well.

Speaking of choosing the right tools, you have the chance to give Nutrient Workflow a test drive today. Starting small with a short trial can lead to great things for your business!