CapEx formula: Reducing errors in capital expenditure through automation

Table of contents

The CapEx formula — ΔPP&E + Depreciation — shows how much a company invests in long-term assets. Automating CapEx processes improves accuracy, speeds up approvals, and ensures compliance by eliminating manual errors and adding structure.

This post will explore how to calculate CapEx, why precision matters, and how automation can eliminate common pain points in CapEx management.

Try Workflow Automation free for 14 days

How to calculate CapEx (capital expenditure)

Understanding how to calculate CapEx is essential for financial forecasting and investment planning. The standard formula is simple but powerful:

CapEx = PP&E (current period) – PP&E (prior period) + Depreciation Expense

Alternatively, it can be expressed as:

CapEx = ΔPP&E + Current Depreciation

Where:

- ΔPP&E refers to the net change in Property, Plant, and Equipment.

- Current Depreciation is the depreciation expense recorded in the current period.

This calculation shows how much an organization has invested in acquiring or improving fixed assets, providing crucial insights for budgeting and strategic decisions.

Example: CapEx calculation

Let’s say a company’s PP&E increased by $500,000 in a year, and its depreciation expense for that period was $100,000. Using the formula:

CapEx = $500,000 + $100,000 = $600,000

This tells us the company made $600,000 in total capital investments, accounting for both asset growth and depreciation recovery.

Watch our full CapEx automation demo video

Want to see CapEx automation in action? Watch our full demonstration video below.

What is net capital expenditure (net CapEx)?

In many analyses, it’s also useful to calculate net CapEx, which accounts for income from the sale of existing assets:

Net CapEx = Gross CapEx – Proceeds from Sale of Fixed Assets

This metric offers a clearer picture of net investments by subtracting any capital recovered through asset sales. It helps assess whether a company is actively growing its asset base or simply replacing older assets.

If the company sold old equipment for $150,000 during the same year:

Net CapEx = $600,000 – $150,000 = $450,000

This indicates that after accounting for asset sales, the net investment in long-term assets is $450,000.

Why manual CapEx management leads to errors

Many organizations still manage CapEx using spreadsheets, email threads, and paper forms — tools not built for precision or scale. This leads to common issues such as:

- Inconsistent or incomplete data collection.

- Human input errors in calculations.

- Delayed or missed approvals due to disorganized workflows.

- Poor audit trails that complicate compliance.

When errors creep into CapEx reporting, it can distort forecasts, hinder capital planning, and affect financial statements.

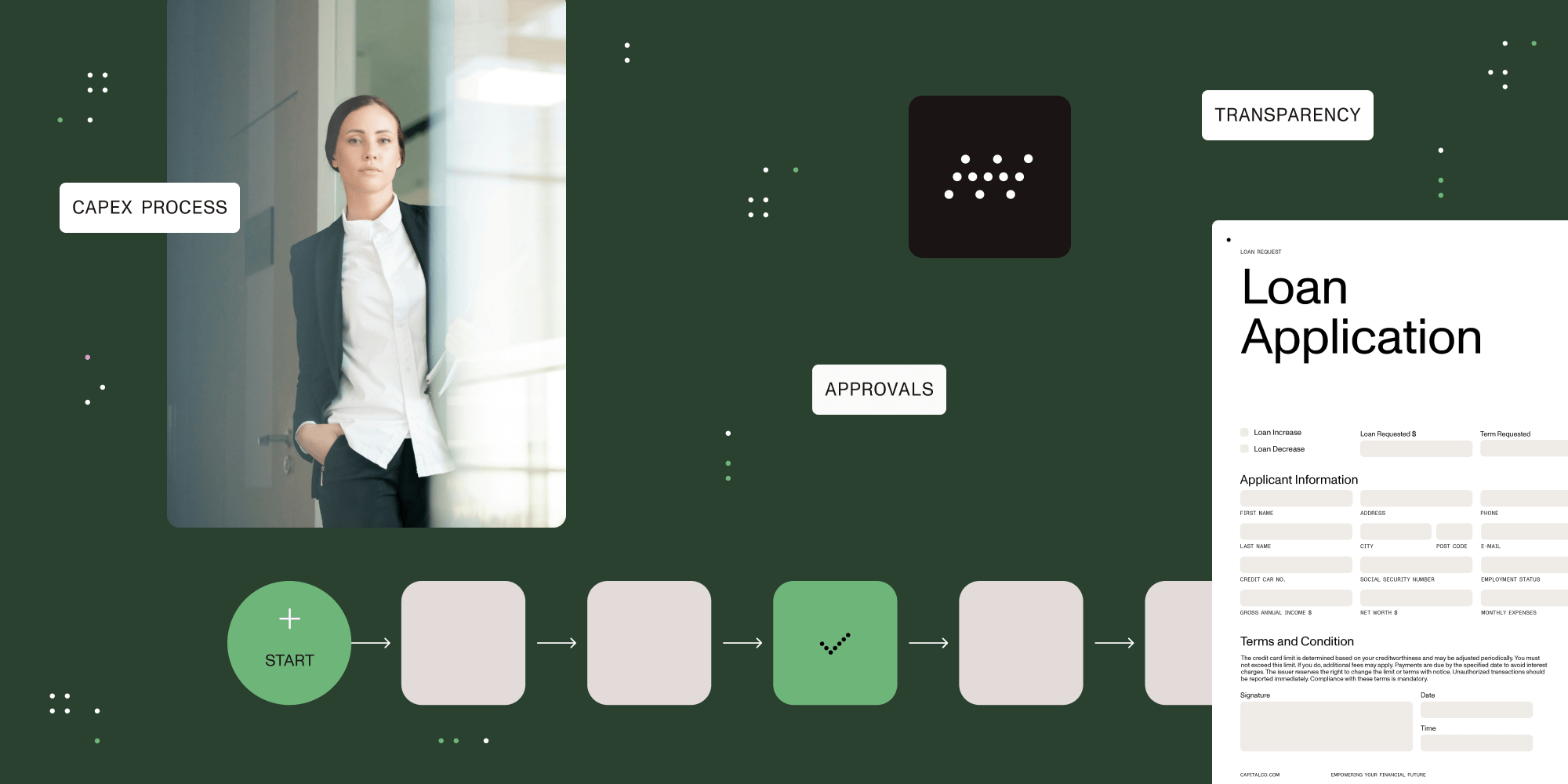

How CapEx automation improves accuracy and efficiency

CapEx automation platforms are designed to standardize and streamline the capital request and approval process. They reduce manual touchpoints and introduce controls that improve data quality and visibility.

Accurate data entry and validation

Automated systems enforce data validation, flag calculation errors, and ensure figures used in CapEx formulas are consistent and complete.

Standardized forms and required fields

Customizable digital forms ensure that every CapEx request includes all the necessary details. This minimizes the risk of omissions and enables faster processing.

Streamlined, auditable workflows

Automated workflows route each request through predefined approval paths, complete with status tracking, deadline notifications, and audit trails.

Key benefits of CapEx automation for organizations

While error prevention is a major advantage, automation offers additional business value:

- Faster processing — Requests can be reviewed and approved up to 30 percent faster compared to manual systems.

- Real-time transparency — Dashboards track request status, bottlenecks, and spending trends.

- Regulatory readiness — Built-in audit trails simplify compliance and year-end reporting.

- Strategic insights — Accurate data enables better forecasting and informed capital investment decisions.

Supporting strategic growth with Nutrient Workflow Automation

Nutrient’s CapEx automation solution is purpose-built to bring clarity, consistency, and control to capital expenditure management. From input validation to final approvals, every part of the process is traceable, auditable, and aligned with financial goals.

Whether you’re optimizing your asset portfolio or scaling operations, automation helps ensure your CapEx strategy is data-driven and error-resistant.

Looking to modernize your CapEx process? Get started with Nutrient Workflow.

FAQ

The CapEx formula is used to calculate capital expenditures and is typically expressed as: CapEx = ΔPP&E + Current Depreciation. It helps determine how much a company has invested in long-term assets.

CapEx automation reduces manual errors, standardizes request workflows, improves approval tracking, and enhances compliance with audit trails.

CapEx represents total investment in fixed assets, while net CapEx subtracts proceeds from the sale of those assets, providing a clearer picture of net growth in asset base.

Manual CapEx processes often lead to input errors, incomplete documentation, slow approvals, and weak audit visibility — all issues that automation can resolve.

Automation validates data entry, enforces form completeness, applies consistent calculations, and routes approvals efficiently, reducing the risk of misreporting.