Workflow automation elevates the efficiency and accuracy of finance processes — from check requests, to general ledger processes and purchasing.

USE CASES

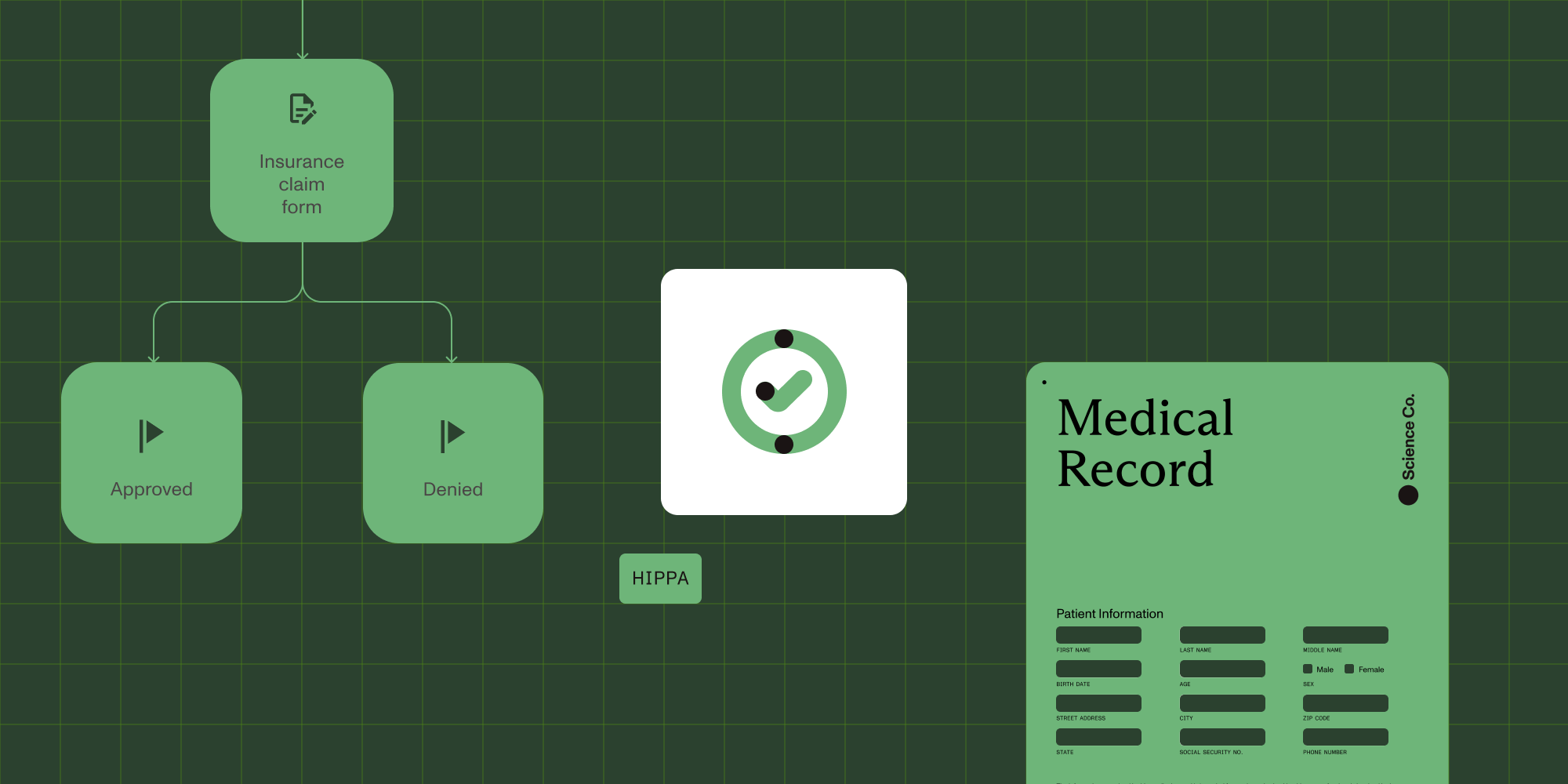

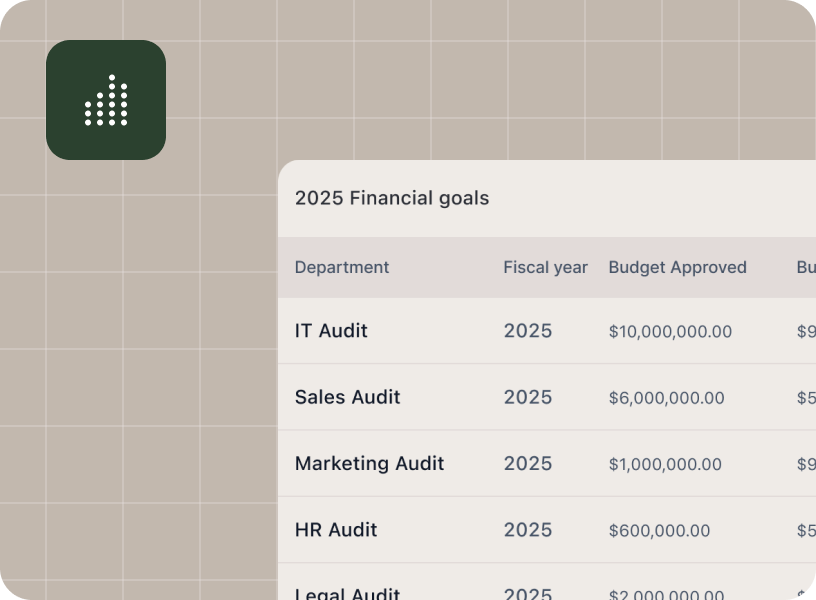

Create high-volume, compliance-sensitive workflows to improve accuracy, speed, and visibility across every financial process.

Streamline the approval process — from application to disbursement — reducing delays and ensuring compliance.

Automate the submission, approval, and reimbursement of expenses, leading to faster processing and better oversight.

Ensure adherence to regulations by automating monitoring, reporting, and documentation processes, reducing the risk of non-compliance.

Automate the collection, consolidation, and review of financial data, ensuring timely and accurate reporting.

Streamline intake using forms that collect project details, budget estimates, rationales, and supporting materials.

PROVEN AT SCALE

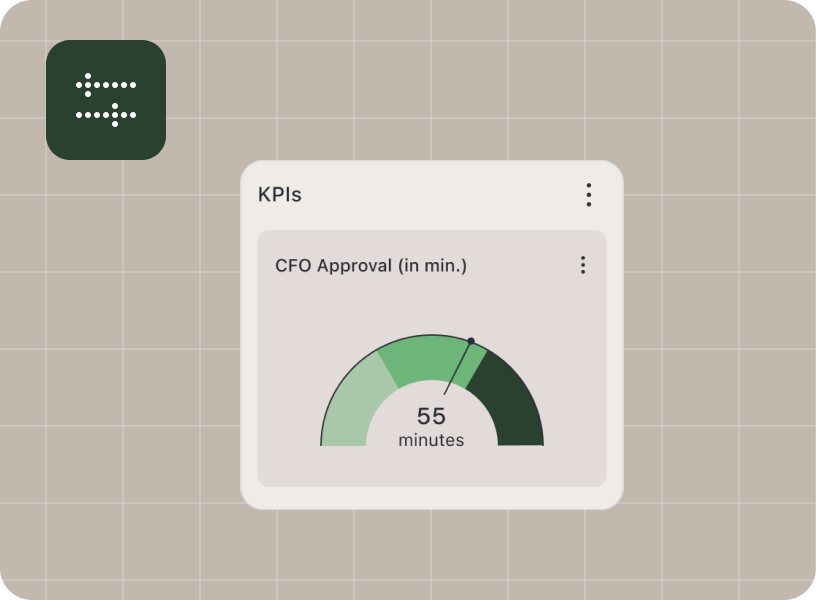

Transformed its CapEx approval process, replacing scattered paper and email workflows with a unified system, enabling faster cycle times and centralized visibility across all sites.

Digitized capital finance approvals and compliance tracking. 150 employees now process hundreds of projects with SAP integration, full SOX compliance, and approvals that complete in a single day instead of weeks.

Replaced paper‑and‑email processes with Nutrient Workflow to automate multilevel asset acquisitions across six Latin American offices — handling 236 requests to date.

Workflow Automation integrates with your tech stack — including finance systems, procurement platforms, and approval tools — using APIs, webhooks, or SFTP. No extra middleware required.

Contact us today to find out how workflow management can help finance and insurance organizations.

Nutrient gives you a drag-and-drop platform to build finance workflows without writing code. Whether it’s expense reimbursements, vendor onboarding, or recurring purchase requests, you can digitize and automate the entire process — approvals, notifications, record-keeping — all in one place.

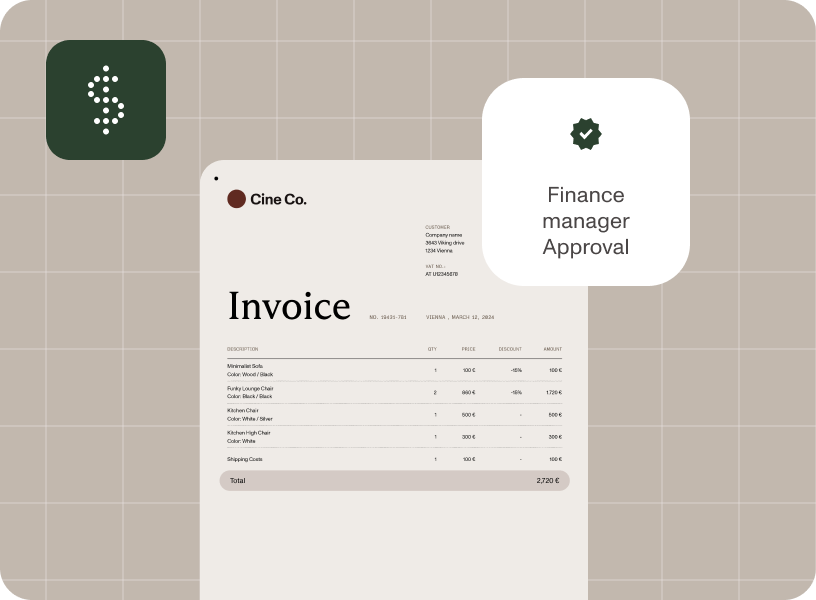

Accounts payable automation solutions are specialized software tools designed to streamline the processing, approval, and payment of invoices and expenses within finance departments. They replace manual, paper-based workflows with automated digital processes that enhance accuracy, speed up approvals, and improve cash flow management, enabling finance teams to operate more efficiently.

Any process that’s repetitive, approval-based, or relies on multiple steps across departments is ideal for automating. Common use cases include:

By automating accounts payable workflows, your finance team can reduce manual data entry and human errors, speed up invoice processing, and maintain better control over payment timelines. This leads to improved operational efficiency, enhanced compliance with financial regulations, and more time for strategic financial activities rather than routine administrative tasks.

Yes. Nutrient plays nicely with the systems you already use — whether that’s SAP, NetSuite, QuickBooks, or a homegrown finance tool. You can pull in data, send updates, and even trigger workflow steps based on financial events or API calls.

Key features to consider include seamless invoice digitization and data extraction, automated approval routing, real-time audit reports for compliance, integration capabilities with existing ERP or accounting systems, secure payment processing, and customizable workflows. Additionally, look for user-friendly interfaces and support for regulatory compliance to ensure a smooth, reliable solution.

No. Finance leaders, operations teams, or even interns can build workflows using our no-code interface. But if your developers do want to get under the hood, there’s full API support for more advanced use cases.

Very. Nutrient’s infrastructure is built with enterprise-grade security, encryption, and access controls. You can enforce role-based access, lock down sensitive forms, and even redact data on the fly. Your CFO can sleep easy.

Absolutely! Our solution is designed to integrate seamlessly with a variety of existing ERP systems, accounting software, and workflow platforms. This integration ensures data flows smoothly between your financial systems without manual intervention, providing a cohesive and efficient financial operation environment.

Less manual work, fewer delays, and way fewer errors. That translates to faster processing times, better vendor relationships, stronger compliance, and measurable savings. It’s like compound interest — the earlier you start, the bigger the gains.